This presentation looks at the cost of collecting the income tax. The IRS overhead itself represents the direct cost to the government in generating this revenue. Beside that there is the burden put on the tax payer in preparing his return, in the case of an audit there may be the cost of representation before a tax court. You also become aware of the vast amount of human resources wasted on this activity for the revenue generated.

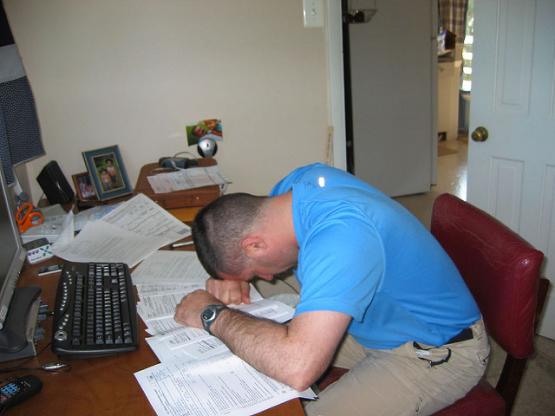

Do we need to suffer like this (and/or pay someone else) in order to fund government? In this presentation, HGS instructor Bob Jene looks at what it costs to collect income taxes. The direct cost to the government of operating the Internal Revenue Service is only a small part, as the burden put on the taxpayer, and the diversion of effort from productive uses, should also be considered.