As farmland yields to “higher-value” uses, how (and how well and how inexpensively) will we eat? Bob Jene reviews data from a leading agricultural preservation organization, the American Farmland Trust (AFT). Among other things they buy development rights from landowners to insure continued farming use, and attempt to facilitate community supported agriculture which makes family farms more viable. A Georgist fiscal reform encourages more conservative and productive use of all land and reduces sprawl, thus preventing encroachment on farmland. An alliance with AFT would benefit us both.

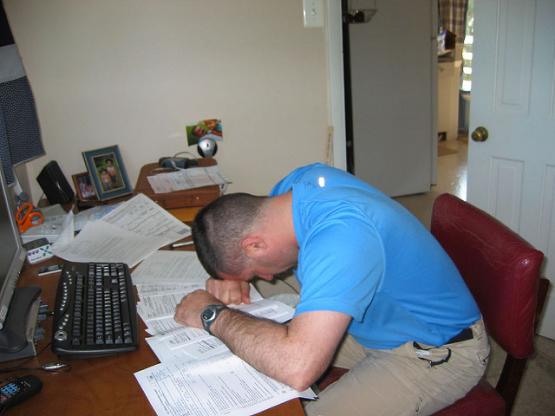

Do we need to suffer like this (and/or pay someone else) in order to fund government? In this presentation, HGS instructor Bob Jene looks at what it costs to collect income taxes. The direct cost to the government of operating the Internal Revenue Service is only a small part, as the burden put on the taxpayer, and the diversion of effort from productive uses, should also be considered.

ProPublica Illinois investigative reporter Jason Grotto (formerly with the Chicago Tribune) has produced several major research stories about problems with real estate assessments in Cook County, as well as with the Assessor’s office itself. He’ll join us to talk about how and why he undertook this work, what’s wrong with the Assessor’s office and how it could be repaired, how the property tax would function if it were competently administered, and, if we’re lucky, how the tax could be restructured to improve fairness and better fund public services while promoting economic opportunity.

Join us to learn about some of the practical difficulties in bringing competence and efficiency to the administration of what could be a very fair tax.

PREREGISTRATION MANDATORY: Due to building policies you must pre-register by email or or by phoning us at 312 450-2906