This presentation looks at the cost of collecting the income tax. The IRS overhead itself represents the direct cost to the government in generating this revenue. Beside that there is the burden put on the tax payer in preparing his return, in the case of an audit there may be the cost of representation before a tax court. You also become aware of the vast amount of human resources wasted on this activity for the revenue generated.

An evening with Bob Jene to compare the Georgist fiscal reform to the TARP bailout, “Fair Tax,” Flat Tax, Bush tax cuts and government money creation. A gist of each proposed or attempted solution to the “great recession” will be given including QE I, QE II and QE III. Attendees will rank the proposed remedies on a scale of 1 to 10 based on 8 criteria.

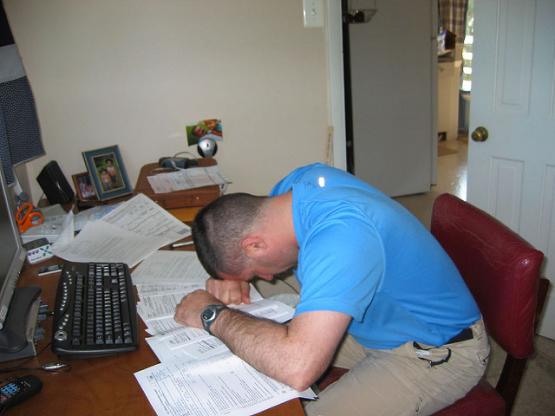

Would Rube Goldberg have been able to design a less straightforward system of funding government than the U S Federal income tax? In this presentation, HGS instructor Bob Jene looks at what it costs to collect this revenue. The direct cost to the government of operating the Internal Revenue Service is only a small part, as the burden put on the taxpayer, and the diversion of effort from productive uses, should also be considered.

An evening with Bob Jene to compare the Georgist fiscal reform to the TARP bailout, “Fair Tax,” Flat Tax, Bush tax cuts and government money creation. A gist of each proposed or attempted solution to the “great recession” will be given including QE I, QE II and QE III. Attendees will rank the proposed remedies on a scale of 1 to 10 based on 8 criteria.

An evening with Bob Jene to compare the Georgist fiscal reform to the TARP bailout, “Fair Tax,” Flat Tax, Bush tax cuts and government money creation. A gist of each proposed or attempted solution to the “great recession” will be given including QE I, QE II and QE III. Attendees will rank the proposed remedies on a scale of 1 to 10 based on 8 criteria.

Do we need to suffer like this (and/or pay someone else) in order to fund government? In this presentation, HGS instructor Bob Jene looks at what it costs to collect income taxes. The direct cost to the government of operating the Internal Revenue Service is only a small part, as the burden put on the taxpayer, and the diversion of effort from productive uses, should also be considered.

Between 1948 and 1973, Americans’ real wages rose almost as fast as their productivity. After 1973, productivity grew 147% but wages rose only 19%. This raises two questions:

(1) If workers getting less, who is getting more?

(2) Is there a way to restore the balance?

To solve the problem of poverty, and the many other problems that follow from it, ordinary workers need higher wages. George Menninger describes how to raise wages without interfering in the free market and without taking anyone’s earnings.

George Menninger is an instructor at the Henry George School of Chicago, and attendees at this free program will have the opportunity to sign up for his Progress & Poverty course.

You can sign up for this free event thru Eventbrite, or RSVP directly by email.

Between 1948 and 1973, Americans’ real wages rose almost as fast as their productivity. After 1973, productivity grew 147% but wages rose only 19%. This raises two questions:

(1) If workers getting less, who is getting more?

(2) Is there a way to restore the balance?

To solve the problem of poverty, and the many other problems that follow from it, ordinary workers need higher wages. George Menninger describes how to raise wages without interfering in the free market and without taking anyone’s earnings.

George Menninger is an instructor at the Henry George School of Chicago, and attendees at this free program will have the opportunity to sign up for his Progress & Poverty course.

No reservation is required, but you can let us know by email that you’re coming.

Between 1948 and 1973, Americans’ real wages rose almost as fast as their productivity. After 1973, productivity grew 147% but wages rose only 19%. This raises two questions:

(1) If workers getting less, who is getting more?

(2) Is there a way to restore the balance?

To solve the problem of poverty, and the many other problems that follow from it, ordinary workers need higher wages. George Menninger describes how to raise wages without interfering in the free market and without taking anyone’s earnings.

George Menninger is an instructor at the Henry George School of Chicago, and attendees at this free program will have the opportunity to sign up for his Progress & Poverty course.

No reservation is required, but you can let us know by email that you’re coming.

ProPublica Illinois investigative reporter Jason Grotto (formerly with the Chicago Tribune) has produced several major research stories about problems with real estate assessments in Cook County, as well as with the Assessor’s office itself. He’ll join us to talk about how and why he undertook this work, what’s wrong with the Assessor’s office and how it could be repaired, how the property tax would function if it were competently administered, and, if we’re lucky, how the tax could be restructured to improve fairness and better fund public services while promoting economic opportunity.

Join us to learn about some of the practical difficulties in bringing competence and efficiency to the administration of what could be a very fair tax.

PREREGISTRATION MANDATORY: Due to building policies you must pre-register by email or or by phoning us at 312 450-2906